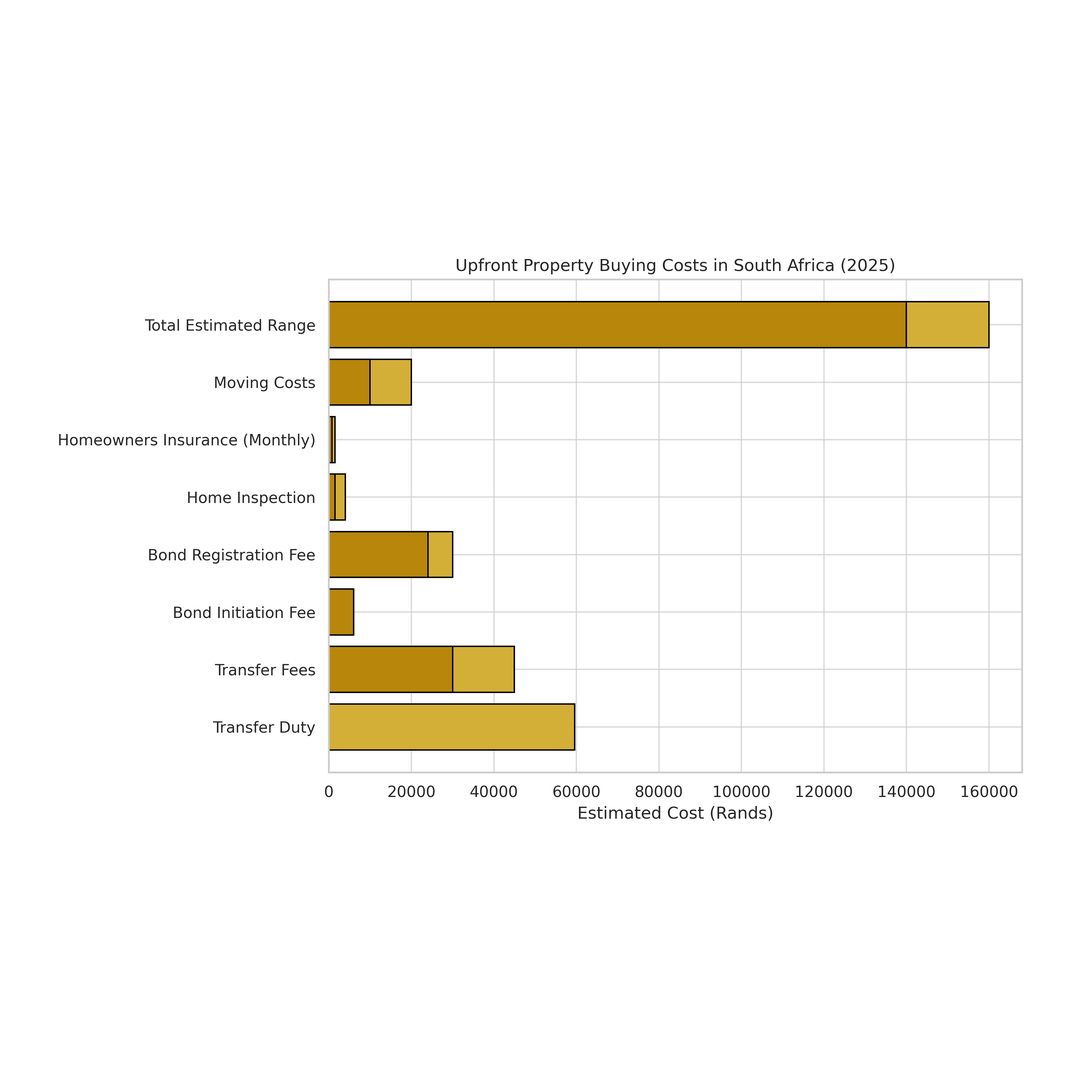

| Buying a home is an exciting milestone — but it comes with more than just the listed price. There are several upfront and behind-the-scenes costs that can catch buyers off guard if they’re not factored in early. Here’s a practical guide to the true costs of buying property in South Africa in 2025. The Market at a Glance – 2025 The property market remains stable in 2025, with modest price growth, especially in well-located suburbs and secure estates. Interest rates are around 11.75%, and while inflation has eased slightly, the cost of living still affects overall affordability. Having a full view of the buying costs can help you plan better — and avoid surprises later. What You’ll Need to Budget For 1. Transfer Duty A tax paid to SARS (South African Revenue Service) when you buy a property. It’s based on the purchase price and doesn’t apply to properties under R1,210,000. 2025 Transfer Duty Rates: • Up to R1,210,000 – No duty • R1,210,001 – R1,655,000 – 3% of value above R1,210,000 • R1,655,001 – R2,250,000 – R13,350 + 6% above R1,655,000 • R2,250,001 – R11,000,000 – R44,550 + 8% above R2,250,000 • Over R11,000,000 – R1,026,000 + 11% above R11,000,000 This is paid before the property is registered in your name. 2. Transfer Fees These are legal fees paid to the conveyancer — the attorney who handles the legal work of transferring the property to your name. The cost is based on the property’s value and is separate from the tax above. • For a R2 million home: ± R30,000 – R40,000 (plus VAT) 3. Bond Registration & Initiation Fees If you’re getting a home loan: • Bond initiation fee: ± R6,037 (once-off, charged by the bank) • Bond registration fee: ± R24,000 – R30,000, depending on the loan amount This covers the cost of registering your bond (loan) at the deeds office. 4. Certificates of Compliance (COC) These are usually the seller’s responsibility, but buyers should still be aware of them — especially in private or off-market deals. These include: • Electrical Compliance Certificate (COC): Legally required for transfer • Gas Certificate (if applicable): Required if the property has gas installations • Beetle/Plumbing Certificates (optional or area-dependent): Common in coastal regions 5. Home Inspection (Optional but Recommended) Not mandatory, but it’s wise to inspect the condition of the home before purchase. A typical inspection will check for structural issues, damp, roofing, and other potential red flags. • Cost: ± R1,500 – R4,000 6. Homeowners Insurance If you’re financing the property, this will be required by the bank. It covers you against damage like fire, storms, and theft. • Budget: ± R800 – R1,500 per month 7. Occupational Rent If you move in before registration is complete, you’ll pay occupational rent — a daily amount agreed upon in the offer to purchase. 8. Moving & Setup Costs • Movers, boxes, and potential upgrades or furniture: expect R10,000+ Example: Total Costs on a R2.5 Million Property (2025) Cost Item Estimated Amount Transfer Duty R59,550 Transfer Fees R35,000 – R45,000 Bond Initiation Fee R6,037 Bond Registration Fee R25,000 – R30,000 Home Inspection ± R2,500 Homeowners Insurance ± R1,000/month Moving Costs ± R10,000+ Estimated Total Once-Off R140,000 – R160,000 Bonus: Costs When You’re Selling If you’re selling a property, factor in these key expenses: • Agent Commission: Usually 5% – 7.5% of the selling price, plus VAT • COC Certificates: ± R1,000 – R3,000 each, depending on the work required • Bond Cancellation Fee (if applicable): ± R4,000 – R6,000 ✅ Final Word Whether you’re buying or selling, property comes with more costs than just the price tag. Planning ahead for these expenses will help you avoid delays, budget confidently, and keep the process smooth from start to finish. If you’re unsure about anything, it’s always worth getting advice from a conveyancer or your estate agent — that’s what they’re there for. The property cost infographic is based on a R2.5 million property purchase in South Africa (2025). Here’s a quick reference from the breakdown:

Based on:

• Property Price: R2,500,000

• Buyer Costs: Includes estimated ranges for Transfer Duty, Legal Fees, Bond Costs, Inspection, Insurance, and Moving

• Estimated Total Upfront Costs: ± R140,000 – R160,  |